How to Complete Blue Sky Filings for Your SPV (Part 4 of the Security Filings Series)

Welcome to All Things SPVs, Sally’s educational series focused on simplifying the world of Special Purpose Vehicles. In this post—Part 4 of our Security Filings series—we cover the step-by-step process for filing Blue Sky notices with U.S. states through the NASAA EFD system. If you haven’t reviewed Parts 1 through 3 (Form D Overview, EDGAR […]

How to File Form D for Your SPV: A Complete Guide to SPV Administration (Part 3)

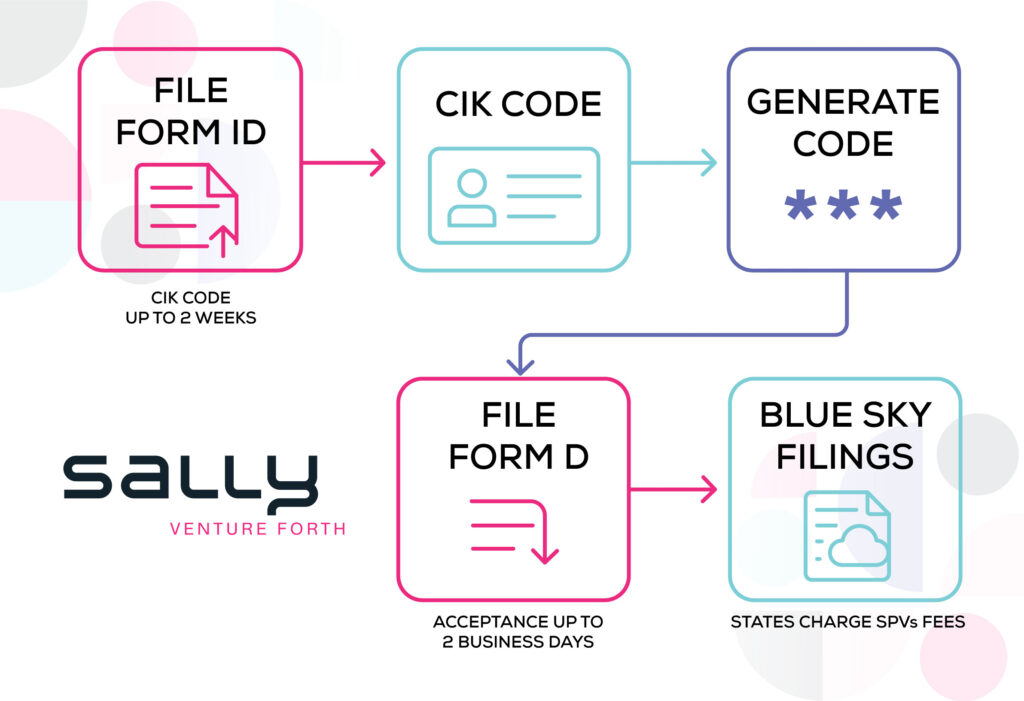

Welcome to All Things SPVs, Sally’s educational series dedicated to simplifying Special Purpose Vehicles. In this guide, we walk through how to file Form D with the SEC as part of your SPV’s compliance and regulatory obligations. Catch up on the basics with our Form ID guide (Part 1) or CCC setup (Part 2). (Internal: […]

Security Filings Part 2: Codes (CIK & CCC) – All Things SPVs

All Things SPVs — Security Filings Part 2: Codes (CIK & CCC) Welcome back to All Things SPVs, a Sally educational series designed to simplify SPV administration and help organizers confidently navigate the filings required to launch and manage a compliant Special Purpose Vehicle.https://youtu.be/BjYsET3Uoyk Whether you’re using an SPV to run a deal-by-deal syndicate, a […]

SPVs: The Most Flexible Investment Structure in Modern Private Markets

The Versatility of SPVs: Why Special Purpose Vehicles Are Becoming the Future of Private Investing Special Purpose Vehicles — commonly called SPVs — have quietly become one of the most important and flexible investment structures in private markets. Once used primarily by angel groups and venture syndicators, the modern SPV now supports dozens of investment […]

How to File a Form ID: The First Step in Your SPV’s Securities Filing Journey

How to File a Form ID: The First Step in Your SPV’s Securities Filing Journey Before you can file a Form D or complete your Blue Sky filings, you need credentials to access the SEC’s EDGAR system. You begin with filing a Form ID. In the world of SPVs (Special Purpose Vehicles), filing Form ID […]

SPV Formation Cost Comparison: Delaware vs Cayman vs Luxembourg vs Guernsey

When launching a Special Purpose Vehicle (SPV), choosing the right jurisdiction can drastically affect both cost and operational complexity. Each jurisdiction has its own purposes and value and its own filing fees, maintenance requirements, and expectations for local presence. Below, we compare four major SPV domiciles—Delaware, Cayman Islands, Luxembourg, and Guernsey—using the Delaware Series LLC […]

How to Work with Sally SPV Document Templates

This blog post is a step-by-step guide to using Sally’s SPV document templates, including the Operating Agreement, Subscription Agreement, and Private Placement Memorandum (PPM). It explains how to customize each document for your specific SPV deal, identifies the key fields to edit, and offers tips for maintaining consistency across all templates. Designed for SPV organizers […]

From Pies to SPVs: Why I Built Sally

This blog post shares the origin story behind Sally, the all-in-one automated SPV platform, through a powerful analogy of scaling a pie business. From manual, labor-heavy processes to high-volume automation, the story highlights why traditional service models break under pressure—and how Sally solves that with scalable, white-labeled SPV automation. Ideal for fund managers, syndicators, and […]

The Big Beautiful Bill and SPVs: What You Need to Know

This blog post explores how the One Big Beautiful Bill Act (BBB), signed into law in July 2025, impacts Special Purpose Vehicles (SPVs) used in Reg D 506 offerings. It breaks down the bill’s effects on QSBS tax benefits, securities regulations, capital gains, and investor definitions—highlighting where SPVs stand to benefit, remain unaffected, or face […]

Banks Are Like People—Weird, Wonderful, and All Over the Place

Discover why no two banks are alike when it comes to managing your SPV. Based on insights from over 10,000 SPVs, this guide explores key trade-offs in banking—technology, interest income, compliance, customer service, and more—helping SPV organizers choose the right bank for their top priorities. Let me know if you’d like variations with different keyword […]