Learn how to stay compliant when raising capital through SPVs. This guide breaks down what counts as investment advice, when ERA or RIA registration is required, and how to navigate state exemptions and no-action letters. A must-read for fund managers, syndicate leads, and startup investors.

ERA, RIA, and No-Action Letters: Navigating Regulatory Compliance in Capital Raising

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult legal counsel for guidance specific to your situation.

Understanding Regulatory Compliance in Capital Raising

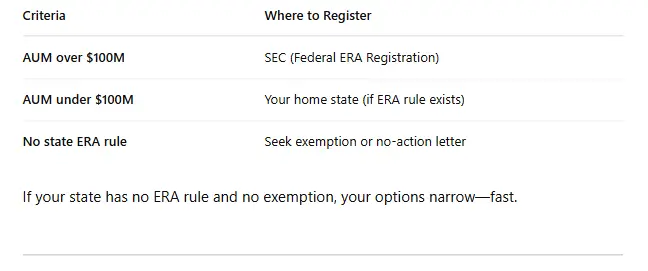

If you’re organizing a capital-raising Special Purpose Vehicle (SPV), chances are you’re also providing investment advice—whether you realize it or not. The moment you offer advice, state and federal regulatory agencies may have jurisdiction over your activity. Compliance can be complicated, but it’s essential.

This guide breaks down three critical areas of compliance:

- What counts as “investment advice”

- Exempt Reporting Advisor (ERA) registration

- State-level exemptions

- No-action letters

🔍 1. What Constitutes Investment Advice?

The term “investment advice” is broad—and regulators interpret it broadly. You may be offering advice if:

- You’re “in the business” of recommending investments or managing SPV-related decisions (e.g., timing a close or capital deployment)

- You’re receiving “compensation” for that advice—including carry, fees, bonuses, or equity

💡 Bottom line: If you’re organizing SPVs, running syndicates, or managing funds—and you’re compensated in any form—you’re likely giving investment advice and must comply with applicable laws.

📝 2. Exempt Reporting Advisor (ERA) Registration

An Exempt Reporting Advisor (ERA) is a lighter-touch version of an RIA. You don’t need to go through the full registration process but must still file a Form ADV (simplified version) annually.

📊 Visual Breakdown: ERA Registration Requirements

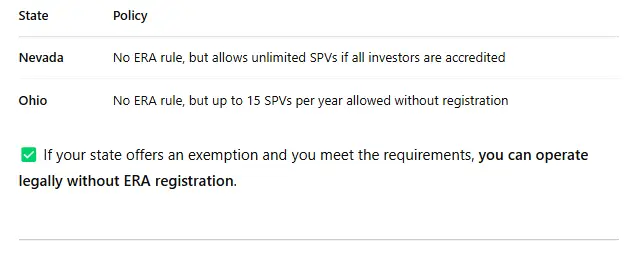

🏛️ 3. State Exemptions

Some states provide their own exemptions to ERA registration. These exemptions allow you to operate without filing under certain conditions:

📍 Example State Exemptions

📨 4. No-Action Letters

If your state offers no ERA rule and no formal exemption, a no-action letter may be your fallback option.

A no-action letter is a written assurance from a state securities regulator that they won’t take enforcement action if you proceed with certain investment activities.

⚠️ Important Caveat: These letters are:

- Fact-specific: Tailored to a unique situation

- Person-specific: Issued to a specific individual or entity

So, while helpful, you can’t rely on someone else’s letter as your own shield although courts have suggested that in some cases no-action letters can be relied on.

Example:

Utah has no ERA rule or exemption, but it has issued a no-action letter that some operators find helpful. Still, it’s not a blanket protection.

🚧 What If Your State Has None of the Above?

If your state offers no ERA rule, no exemption, and no usable no-action letter, you have a few (less ideal) options:

⚖️ Your Options:

- Register as a Registered Investment Advisor (RIA)

- High compliance burden

- Likely overkill for SPV managers

- High compliance burden

- Seek a No-Action Letter

- File your own request with detailed facts

- Takes time and legal guidance

- File your own request with detailed facts

- Advocate for Legislative Change

- Push for new rules or more clarity

- Push for new rules or more clarity

- Relocate

- Some SPV managers choose to move to more favorable states, like California, Texas, or Nevada, that offer clearer pathways

- Some SPV managers choose to move to more favorable states, like California, Texas, or Nevada, that offer clearer pathways

Final Note

Navigating regulatory compliance as a capital raiser can be daunting, but understanding these options—ERA registration, state exemptions, and no-action letters—can help you move forward with confidence.

Always consult legal counsel before proceeding. Compliance mistakes can be costly, and each situation is unique.